Property tax and bills in Spain – What you need to know

So, you have bought that wonderful bit of paradise where you spend as much of your downtime as possible. There are financial obligations for owning a property in Spain and here are some pointers to get you started:

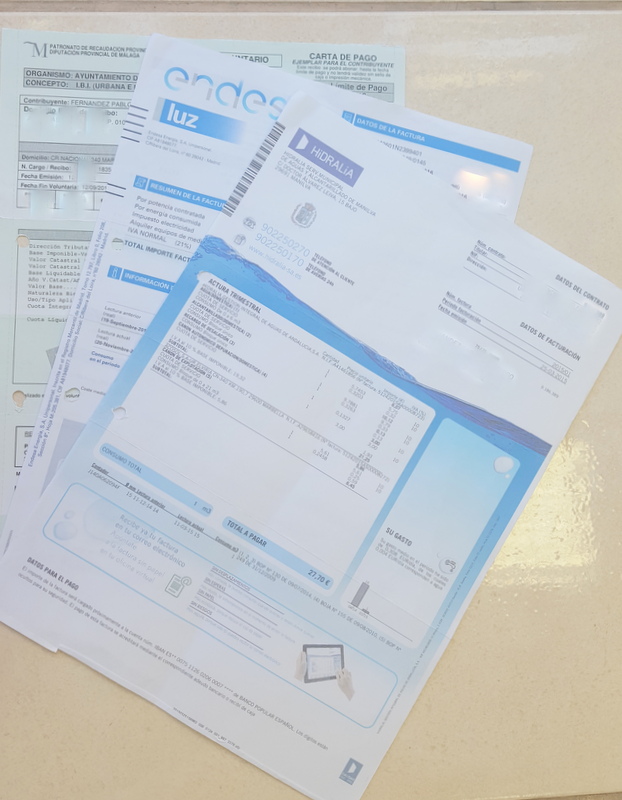

Utilility Bills – Water, Electric & Gas (where applicable)

If you have used a lawyer for your conveyancing, as part of their service they will have transferred the utility bills in to your name – there may be a slight overlap with the previous owner and if so, the lawyer may have kept a retention to ensure funds for any outstanding financial commitment from the previous owner. The water and electric bills are usually around every 2 months, but not exactly and a direct debit should be in place – make sure this has been actioned. With the electric bill, check your consumption is in line with your usage as sometimes the previous owners may have been heavy users and you are more conservative with the level of power you require. You can request your lawyer to ensure this is at the right level or by contacting the provider to inform them direct. Gas is usually in bottles as mainline gas is only available in major cities in Spain. It is certainly cheaper than electric but not as convenient. ***Very Important Point*** Always make sure you have sufficient funds in your bank account to pay your utilities as if there is a failure in collection of a direct debit the utility provider will cancel the direct debit and take steps to cut off supply.

Telephone

There are plenty of providers offering different services including or excluding WIFI but we recommend you shop around and get what´s best for your lifestyle – you may want a fixed line, then Movistar is the main provider, but there are other services on offer if you require cheap calls to your home country or want a plug and play scenario for you and your guests.

Community charge (where applicable)

Community charges vary, depending on the facilities within your community and are usually paid quarterly or monthly. Check with your administrator to ensure you are meeting your commitments and some communities offer a slightly reduced rate if you have set up a direct debit. Failure to keep up to date with community payments could result in loss of using communal facilities, such as the swimming pools, spas, gym, tennis courts etc.

Council tax – Impuesto Sobre Bienes Inmuebles (IBI)

(Impuesto Sobre Bienes Inmuebles) is like the British council tax and usually includes refuse collection although this is sometimes charged separately either with your water or your community payment. It is a yearly bill paid in August, but you can set up a payment to come out monthly.

Property income tax (IRPF/Renta)

Impuesto sobre la Renta de las Personas Fisicas (IRPF if your Spanish property is not rented out or not your primary residence (i.e. a holiday home), you will be liable for the “deemed rental income tax” even if you do not let out your Spanish property. They will assume you are making 2% of this value each year from letting your Spanish property and charge you 25% of that “income”, which equates to a total of 0.5% of the valor catastral (rateable value) of your Spanish property. For example, if you own a Spanish property with a valor catastral (rateable value) of €100,000 and you are not renting it out, you will still be liable for 25% of €2000, which equates to €500. It is important to keep on top of this tax on a yearly basis as you can be charged interest and fined if not paid on time.

Home Insurance

Shop around – the banks will offer insurance when you are completing on a property, but see what other providers can offer and always when it comes to renewal – check your renewal timeframe as some ask for 90 days’ notice if you are changing to another provider.

Car Ownership

If you own a car you are responsible for ensuring the car is roadworthy and if the car is over 4 years old, the car will require a yearly ITV (MOT). The test centre is based in Estepona in the industrial area (Poligono) and an appointment is required so it is best to ensure you make it in advance of the expiry date. Insurance papers, details of the car, driving licence must be with you at all times when driving in Spain because if you are stopped by the police or Guardia civil and fail to produce the correct documents, can result in a fine. Whether you are buying a new or second-hand car, it is very important as the new owner you ensure the address details are correct as soon as possible and not rely on the person or business who has sold you the car to complete the paper trail.

This information is purely informative and only from our own experiences, but we highly recommend if you are unsure of your commitments, get an independent lawyer to check all is correct.